Prices for used electric vehicles are falling fast, even for high-end brands that used to keep their value. This big change in the used EV market is getting a lot of attention. What’s causing these price drops? How are companies changing their plans to deal with this? This blog looks at why costs are going down, shares a detailed market report, and examines how businesses are managing to sell used electric cars. Stick till the end to find what might happen next in the electric vehicle world.

What is A Used EV Market?

The used electric vehicle (EV) market is the marketplace for buying and selling previously owned electric cars. It’s a rapidly growing market because more people are buying new electric vehicles. Used EV prices are becoming more affordable, making them a more attractive option for budget-minded car shoppers. There are some important considerations to be kept in mind when buying a used EV compared to a traditional gasoline car, but with the right research, you can find a great deal on a quality electric vehicle.

Used EV Price Crash Gets Deeper with Premium Brand Idea History

Back in February, something surprising happened: the prices of used electric vehicles (EVs) fell below those of used gasoline-powered cars for the first time ever. This drop has only gotten steeper as buyers start to reject the “premium” label that was once associated with EVs.

Over the past year, the decline has been quite dramatic. In June 2023, the average price of a used EV was over 25% higher than that of a used gas car. But by May of this year, used EVs were on average 8% cheaper than their gasoline counterparts in the U.S. In dollar terms, the gap widened from $265 in February to $2,657 in May. This data comes from an analysis of 2.2 million one- to five-year-old used cars conducted by iSeeCars. Over the past year, prices of used gas cars have dropped by 3-7%, while used EV prices have plummeted by 30-39%.

The difference in prices between used luxury brands and EVs has also grown. Used BMWs now cost significantly more than comparable all-electric Tesla vehicles. For instance, in May 2023, a Tesla Model 3 was $2,635 more expensive than a BMW 3 Series. By May of this year, the Model 3 was priced over $4,800 less than the 3 Series.

More people are selling their used EVs today than ever before, partly because the market has grown. In 2022, 176,918 used EVs were bought in the U.S. In May alone, that number exceeded 45,000. The used car market is larger than the new car market, and used car values tend to depreciate quickly. Typically, a one-year-old used car is priced at 80% of the new car price. As more EVs enter the used car marketplace at lower prices, more people can afford to buy them, opening the market to first-time EV owners.

There are reasons for the used EV market crash. Battery technology is continuously improving, offering longer ranges on new models, and there are concerns about battery degradation over time. Newer models have better battery life and temperature control for charging. Since 30-50% of an EV’s value is in the battery, improvements in this area can significantly impact prices. However, EVs do have lower overall ownership costs, from fuel to maintenance, and buyers of used EVs can qualify for federal tax credits.

A key factor in the recent decline in used EV prices has been Tesla CEO Elon Musk, who initiated an industry price war in 2023 by cutting prices on Model X, Y, and S vehicles. This continued into 2024 and caused used Tesla prices to drop, followed by decreasing prices across other used EV brands. Scott Case, the CEO of Recurrent, a startup that measures EV battery performance, noted that used Tesla prices have fallen in line with new Tesla price drops, affecting the broader used EV market.

In January, Hertz also adjusted its aggressive EV strategy, selling off 20,000 EVs at Hertz Car Sales locations—about one-third of its EV fleet—at a “no haggle” average price of $25,000.

Declining demand for EVs and inadequate infrastructure have led many auto companies to scale back their EV rollouts and promote hybrid models instead. General Motors, for instance, reduced its projected sales and production of EVs from 200,000-300,000 to 200,000-250,000. EVs accounted for less than 3% of GM’s Q1 sales. Ford has also faced losses from its Model E electric vehicle rollout, even though combined hybrid and EV sales rose in May. Ford decided to end a program that required dealers to invest heavily in EV infrastructure to sell electric vehicles.

The EV charging infrastructure is still developing, which makes switching to EVs challenging for many Americans. However, access to EV chargers is improving. There are over 64,000 publicly accessible EV charging stations in the U.S., with more than 176,000 charging ports, according to the Department of Energy. The charging infrastructure has grown by 29% since the Inflation Reduction Act of 2022, which included tax incentives for adopting EVs. In comparison, there are roughly 145,000 gas stations in the U.S.

A Pew Research analysis found that about six in 10 Americans live within two miles of a public charger, though only 7% of those people would consider buying an EV. Most EV charging still happens at home, and there are rural areas with few EV chargers.

A Gallup poll from April showed that EV ownership is increasing by 3% annually, but there is an equal percentage decline in those seriously considering buying an EV, down from 12% to 9%. 35% of Americans said they might consider buying an EV in the future, down from 43% last year. This decline in the used EV market highlights the challenges and evolving perceptions surrounding electric vehicles as they become more mainstream.

Check out our used car buying guide to make informed decisions for your next car purchase!

Used Electric Car Prices & Market Report — Q2 2024

Price Update

Used car prices dropped significantly in the first quarter of 2024. This might be a surprise for EV owners checking their resale value, but it’s great news for many Americans who want to use their tax refunds to buy an electric car.

High prices have been the biggest barrier to EV adoption. Now that EV prices are more competitive with traditional gas cars, we should see more people interested in buying them. This is especially true since more models are falling below the $25,000 used vehicle tax credit threshold, making EVs more accessible and boosting the chance for mainstream adoption. It’s clear that EVs are moving from being a niche market to a mainstream choice for Americans.

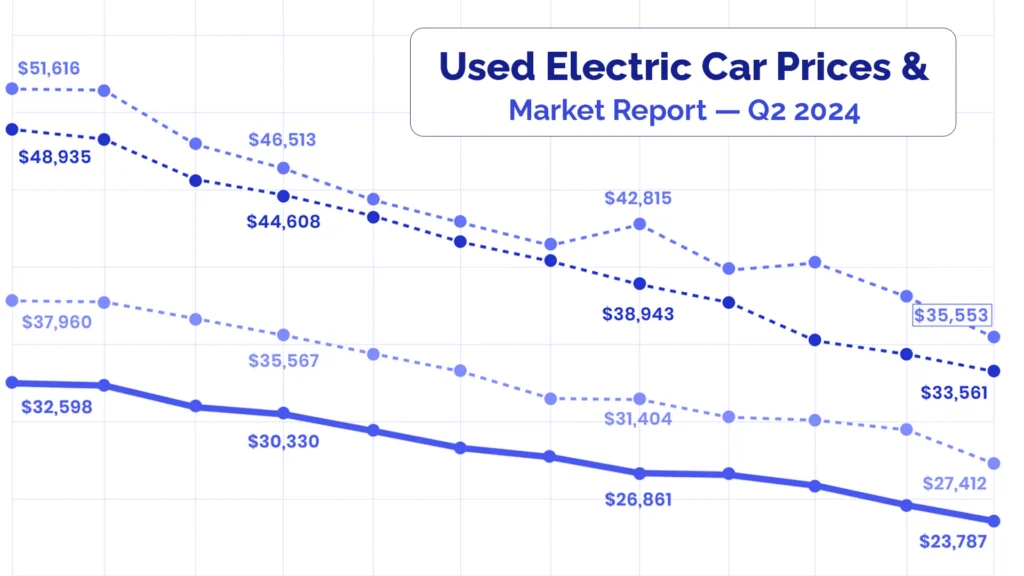

A lot of people are looking for an electric bargain this season. Since used EVs must be priced below $25,000 to claim the tax credit, lower prices mean electric cars are becoming affordable for a new group of buyers who depend on incentives and point-of-sale rebates to go electric. The average used EV price model is now $23,787—a 27% drop from last year.

Looking at used Tesla models, we see similar trends:

1. 2+-year-old Model 3s have dropped 27% year over year

2. 2+ year-old Model Ys have dropped 31% year over year

3. 2+ year-old Model Ss have dropped 32% year over year

A used Model 3 is now affordable for many people who couldn’t afford it before. This means more people can own an EV, which is great for the environment and for EV adoption. The models included in the 2023 Price Index are:

1. 2017 Chevrolet Bolt

2. 2018 Nissan LEAF

3. 2018 Toyota Prius Prime

4. 2019 Tesla Model 3

5. 2019 Chevrolet Volt

6. 2020 Tesla Model Y

7. 2020 Hyundai Kona EV

8. 2021 Ford Mustang Mach-E

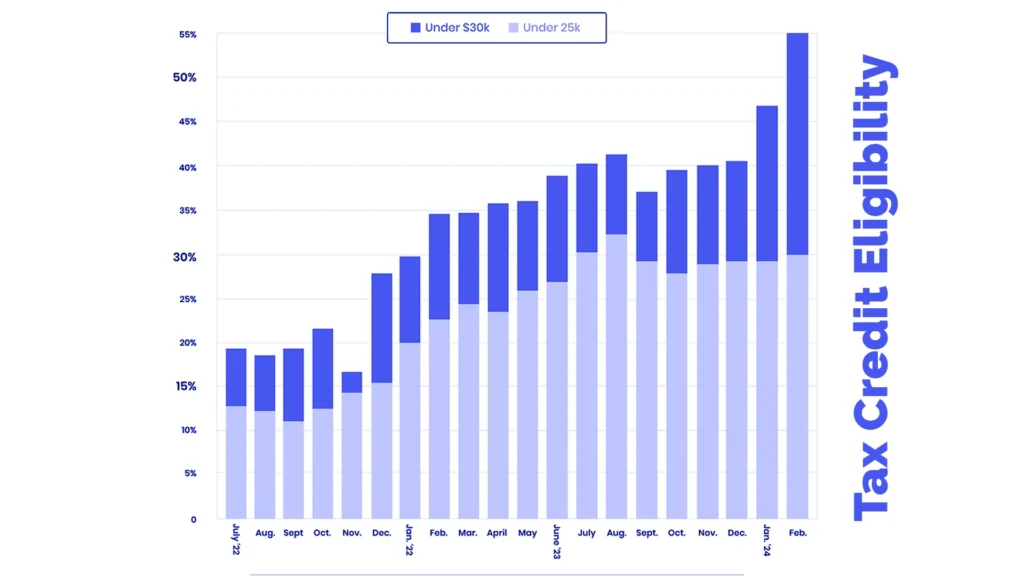

The percentage of used EV listings under $30,000 has skyrocketed to 55%, while the percentage under $25,000 has stayed around 30% for months. This suggests that either prices and demand for EVs under $25,000 have stabilized, or vehicles under $25,000 are selling quickly while those above that price pile up. In either case, we can expect demand to rise in used EV prices to stabilize by the end of the quarter.

Dealerships are benefiting from these used EV bargains. For example, a dealership in Utah reported a record sales month in February, thanks to these under $25,000 “tax cars.” Falling prices mean adoption will increase dramatically as long as supply can keep up. Demand for used EVs under the $25,000 tax cap will continue to grow.

Tax Credit Eligibility

Most EVs on the road (70%) are from 2022 or earlier, and over 83% of used EV listings are from 2022 or earlier. But as demand grows, the supply of these “tax cars” might face challenges. Consumers will have to accept higher-mileage EVs to stay under the price limit, but concerns about battery health and warranty are largely unfounded since these batteries are lasting longer than predicted.

It’s important to note that as of 2024, tax credit-eligible sales must go through dealerships registered with the IRS. Unfortunately, many dealerships have been slow to support the point-of-sale rebate on EVs, despite the sales opportunity it presents. This has created opportunities for other dealerships to boost sales using federal tax credits. Inexpensive electric cars are not limited to the second-hand EV market. In the new EV market, 60% of tax credit-eligible models are priced below the average sale price of a gas car.

Price Parity

Thanks to falling costs of lithium and battery packs and a shift to more affordable EVs, predictions indicate that the average price of new EVs will match the average price of gas cars by the end of 2024, accelerating demand for electric cars.

As of December 31, 2023, the average price for a new EV was just $2,000 more than a gas car. When considering tax credit-eligible EVs, the average price after rebate is $45,500—$3,000 less than a new gas car. For example, these new EV models are all cheaper than the average new gas car:

1. Chrysler Pacifica PHEV: $46,120 after tax credit

2. Volkswagen ID.4: $31,495 – $40,295 after tax credit

3. Chevrolet Bolt EV: $19,000 after-tax credit

This promises to be a big year for used EV sales, with a 100% increase in sales volume from 2022 and a 40% increase from 2023. The federal EV tax credit is now available for some of the most sought-after and reliable EVs. With over 3 million EVs on the road, 70% of which are from 2022 or earlier, many may qualify for the Used EV Tax Credit. This is exciting news since the tax credit can now be used as a point-of-sale rebate or credit at the dealership.

Why the Cost of Buying A Used Electric Car is Plummeting?

The price of used electric vehicles (EVs) has been going down a lot lately, showing a big change in the EV used market. This drop is because of several important reasons that are making EVs more affordable and easier for people to buy. Let’s look at why used EV prices are falling:

1. Price Wars: In 2023, Tesla CEO Elon Musk started a price war by cutting prices on his company’s vehicles. Other automakers followed suit, leading to lower prices across the market.

2. Intense Competition: With more automakers entering the EV market, competition has become fierce, driving prices down.

3. Manufacturing Innovations: Advances in manufacturing and assembly processes have reduced production costs, which translates to lower prices for consumers.

4. Declining Battery Prices: Battery prices have fallen nearly 90% between 2008 and 2022, significantly lowering the overall cost of EVs.

5. Tax Incentives: New tax incentives allow dealers to cut up to $4,000 off the price of some used and leased EVs, making them more affordable.

6. Robust Used Market: The growing used market is providing budget-conscious buyers with more options, making EVs accessible to a broader audience.

New electric cars are cheaper than ever, and the thriving used electric vehicle market is finally offering budget options for prospective buyers. This is great news for overall EV adoption, but frustrating for owners who bought EVs at high prices and now see their cars losing value rapidly in the resale market. You can check out the best prices on the best-used car websites of 2024.

Electric vehicle prices have come down since 2008, when Tesla sold its first model, the Roadster, for $109,000. However, many Americans still find them too expensive. A recent poll by Edmunds found that 47% of potential EV buyers want to spend $40,000 or less, a standard not many EVs in the United States meet.

For budget-conscious consumers, buying a used EV hasn’t always been an option. During the pandemic and the resulting chip shortage, some used Teslas even cost more than new ones. This situation has changed. Used EV prices are now more affordable, partly due to Elon Musk’s successful year and improvements in battery technology, which make drivers less anxious about running out of power.

Tesla’s pricing strategy has played a significant role. Shortly before Musk urged his executives to go “absolutely hardcore” with layoffs, Tesla reduced prices on three models by $2,000 each, following several other price cuts over the past year. Tesla controls 51% of the EV market, so its pricing decisions have a substantial impact. As a result, the cost of used EV range has dropped by about 10% since last year.

Another factor is the influx of used EVs from Hertz. In 2021, Hertz launched an electric vehicle campaign featuring retired NFL star Tom Brady, aiming to buy 100,000 Teslas and rent them to Uber drivers. The plan didn’t work as expected. This year, Hertz decided to reduce its electric fleet by 30,000 vehicles, flooding the used EV car market with used Chevy Bolts, Tesla Model 3s, and other EVs for sale.

How Companies are Making it Work with Selling Used EVs?

New businesses are emerging to specialize in selling used electric vehicles (EVs), taking advantage of lower prices in the market. These price drops have been driven by several factors.

Firstly, the price of used Teslas has seen a significant decline since mid-2022. This was spurred by Tesla reducing prices for new vehicles and the car rental giant Hertz selling a large number of used Teslas at discounted rates.

Secondly, the Inflation Reduction Act introduced a $4,000 tax credit for eligible used EVs. This tax credit can be directly applied to the down payment of a vehicle purchase. It’s particularly beneficial for buyers with lower incomes who may not otherwise qualify for the full credit due to their federal tax liability.

One of the main challenges faced by these new companies is persuading traditional auto dealerships and lenders to embrace the sale and financing of used EVs. However, innovative dealerships and financing firms are stepping up to meet this demand.

The affordability of used EVs has never been better, with over half of them in the U.S. priced at $30,000 or less currently. This makes EVs a viable option for budget-conscious consumers, especially considering the long-term savings on fuel and maintenance costs.

However, selling used EVs presents unique challenges compared to conventional vehicles. Dealers and lenders are still grappling with how to accurately assess the value of used EVs, particularly factors like battery health which significantly impact resale value and financing risk.

Efforts are underway to simplify the process of combining the $4,000 federal tax credit with state and local incentives, providing buyers with a substantial upfront discount. This is crucial in attracting buyers who may face financial barriers to purchasing an EV upfront.

The used electric vehicle market is expanding rapidly, with sales increasing and prices decreasing. Companies specializing in EV financing are experiencing heightened demand, indicating a growing interest in affordable electric vehicles. While there are hurdles to overcome, the rising popularity of used EVs and supportive policy measures point towards a promising future of used car market for electric cars.

What Will Happen Next to EVs?

Electric cars aren’t going to completely replace gas-powered vehicles anytime soon, but the shift has already begun. Many changes are needed to make electric cars the norm. We need more batteries and better charging stations, and car companies must switch to making only electric cars. Most importantly, consumers need to want these changes and start buying more electric vehicles (EVs).

In 2021, EV sales almost doubled from the previous year, reaching 6.6 million cars. This brought the total number of electric cars on the road to 16.5 million. While this is still a small percentage of all cars, the growth rate is speeding up. By the end of 2024, there could be over 100 different EV models available. Here’s what experts predict for the future:

1. By 2025, EVs could make up 20% of all new car sales.

2. By 2030, EVs could reach 40% of new car sales.

3. By 2040, nearly all new cars sold could be electric.

The future of electric vehicles (EVs) hinges on various factors and developments. Understanding these elements is crucial for predicting the shift from gas-powered to electric cars. Here’s a look at what lies ahead for the used EV market:

1. Fleet Turnover

This term refers to how quickly new vehicles replace older ones on the road. Modern gas cars last longer, so it will take more time for EVs to fully take over.

2. Automaker Conversions

Car manufacturers are gradually switching to making only electric cars. Some plan to stop selling gas cars by 2035, while others may take until 2045 or later unless new laws force them to speed up.

3. Legislation

Several states have passed laws or issued executive orders to ban the sale of new gas cars by 2035. If this becomes a national policy, most cars on the road by 2050 could be electric.

4. Infrastructure

More EVs on the road mean we need more charging stations. Laws are being passed to build these chargers, but it will take years to complete.

Consumer preferences and behaviors significantly impact the adoption of electric vehicles. Understanding these influences is essential for predicting the future of the EV market. Let’s explore the factors driving and hindering consumer acceptance of electric cars:

1. Cost of Ownership

While owning an EV can be cheaper in the long run, buying one can still cost about $10,000 more than a gas car. Plus, installing home chargers and replacing EV batteries can be pricey. EV adoption will rise when these costs become comparable to gas cars.

2. Driving Habits

Remote work trends could affect car buying habits. If people drive less, they might be less inclined to buy new cars, including EVs.

3. Range Anxiety

Many people worry about running out of battery power and getting stranded. This fear should ease as more charging stations are built and batteries become more powerful. Over time, people will realize they often don’t drive far enough for range to be an issue.

Conclusion

The used EV market is evolving rapidly with prices dropping and accessibility increasing, thanks to innovative strategies and market shifts. As more people embrace electric vehicles, the future of automotive industry looks promising for both buyers and sellers in this marketplace. Whether you’re eyeing a sleek Tesla or a reliable Nissan Leaf, now’s a great time to explore the world of used EVs.