Are you tired of securing automobile loans to purchase your desired used car? Do not worry. In this blog below, we will resolve all your queries and provide an informative result to enhance your car-buying journey experience.“Buy here pay here” dealerships offer housing financing to borrowers who fall behind in good credit. If your credit is not in great shape, there are some drawbacks you need to consider. However, our blog is worth considering for your auto loan car route.

What is Buy Here Pay Here Dealership?

When you visit a traditionally used car dealership to purchase a car, the dealership passes the contract to an automotive lender and provides an auto loan to the used car buyer. However, in the US and Canada, buy here pay here dealerships in the used car market extend credit to potential car buyers of automobiles with high interest rates. Buyers with no or bad credit history find it difficult to get auto loans. BHPH dealerships are an opportunity to meet their credit standards.

How Does Buy Here Pay Here Financing Work?

These car lots specialize in selling used cars to people with bad credit or no credit history. They handle the financing themselves, so car buyers won’t need to go through a separate loan approval process. You will find some vehicles at a higher price, like a fully loaded trust with higher mileage, while some affordable cars are lower in price and value. Additionally, some of these dealerships might sell a car that has been repossessed. Further, this can happen multiple times for the exact vehicle, which might be returned to the dealership by different buyers before you.

Unlike traditional dealerships, where car buyers meet a separate loan officer, these dealerships act as sellers and lenders. Car buyers can explain any missed payments, gaps in employment, or other factors that might affect credit scores. Therefore, vehicle buyers can discuss this situation with these dealerships, which often have their criteria for assessing creditworthiness. Additionally, it is more beneficial to highlight the current financial stability, job security, and ability to make payments on time. You can use documents like pay stubs or income statements as proof.

Discover How Leasing a Car Can Be a Better Deal

Leasing a car can help individuals ride a vehicle that might be more expensive than they could afford and have a low monthly payment. However, buying a vehicle limits a buyer’s budget, and they might have a higher monthly payment. We have mentioned how leasing a car can be a better option than visiting a buy here pay here car lots and owning a used car.

1) Higher-end vehicles

Everyone wants to ride a luxury wheel for themselves. Therefore, car leasing allows individuals to drive a luxury ride with an affordable monthly payment. Additionally, drivers can lease for two to three years and easily upgrade to a new ride.

2) Monetary perks

If purchasing a wheel from a buy here pay here cars lot, drivers have to pay a high down payment, and the monthly installment payables are also higher. However, leasing a call allows individuals to enjoy warranties, low down payments, free routine maintenance benefits, and a luxury wheel.

3) Depreciation protection

Car marketplaces values fluctuate wildly whenever an upgraded version launches or because of other external factors. However, leasing a car can be a wise financial move when the car’s value unexpectedly declines. Further, if the leased car value remains high, individuals can purchase it at a good price when the lease expires.

4) Purchase a car

Some car riders who drive a leased car fall in love with it and want to purchase it. Technically, they can purchase the lease car at the end of the lease period as per its terms. The payable price for the leased vehicle is generally the residual value of the car plus the processing fees required by the manufacturer. Additionally, purchasing a vehicle less than its current market value can be a great financial move.

5) Transfer the lease to a new person

Individuals who do not like the car they have leased can also transfer the agreement to a new person. However, they must ensure that the signed contract allows them to do so, and the lease would be transferred for the balance period only. Additionally, we advise you to check the lease documents before signing. Financial companies can also charge a fee of several hundred dollars as a transfer fee.

Explore Pros and Cons of Buy Here Pay Here Dealership

These dealerships are independently owned and focus on local customers to provide them with personalized service. They also trade-in with the car buyers old cars. However, there are also drawbacks to purchasing a vehicle from these dealerships. We have mentioned a list focusing on all the pros and cons of pay here buy here car lots, which will help you make a used car purchasing decision.

| Pros | Cons |

| No credit required: Individuals with bad credit or no credit score mostly find it difficult to opt for an auto loan. However, these dealerships finance potential buyers to purchase their desired used car. | High interest rates: Traditional car loan interest is much cheaper than buying a used car from pay here buy here dealerships. They charge an interest rate of around 20%, four to five times more than a traditional car loan. |

| It’s easy to get a car: These dealerships arrange and lend money to car buyers, making buying a ride quicker and easier for potential buyers. | Track your car: Cars are provided by credit scores or bad credit. These dealerships use tracking devices as a security measure to protect their investment in the car if a borrower defaults on the loan. |

| Trade-in: These dealerships are open for trade-in and will purchase your old car that is not in good condition. Therefore, they will deduct the money from your next used car that you want to purchase. | Odd payment requirements: These dealerships set up loan repayment plans with buyers for monthly or weekly installments, requiring in-person payments. |

| Down payment: Dealerships are flexible regarding down payments. Car buyers who have little or no amount to pay for a down payment can also purchase used cars with these dealerships. | May not report to credit bureaus: Mostly loans from these auto dealerships are not considered or noted in your credit report. Additionally. They also might not help your credit score. |

| Personalized experience: These dealerships are independently owned. Therefore, they focus on providing potential clients with an exceptional, personalized customer experience. | Limited car selection: Traditional dealerships allow buyers to choose the car and determine the financing later. However, BHPH dealerships look at your financing option first and then provide you with a limited set of vehicles. |

Can Buy Here Pay Here Dealerships Affect My Credit Score?

Traditional automotive lenders report your loan payment activity to credit reporting agencies like Equifax, Experian, and TransUnion. Therefore, when individuals make regular loan payments on time, it helps them to improve their credit scores. However, these dealerships are primarily independent, and reporting payment agencies about loan payment activity can cost them significantly enough. Therefore, they prefer not to report the loan payment activity. Often, they do not report your loan payment activity so that it won’t impact your credit score positively or negatively. Additionally, buy here pay here dealers do not prefer to check a credit report when you apply for a loan to make your car buying journey smoother and quicker. If you cannot pay the loan amount, you repossess your car. Dealers will not show your loan payment credit report, saving you from future problems.

Financing will not affect your credit score because the dealer usually does not prefer to run a hard credit check. However, some dealers report your loan payment to credit bureaus, and if you make your payments on time, it will build your credit score.

Unlock the Alternatives to BHPH Financing

Buy here pay here dealerships are an excellent way for individuals to purchase a used car. However, these dealers charge a high interest rate on the vehicles. We advise you to consider the alternatives to financing your auto loan mentioned below before purchasing.

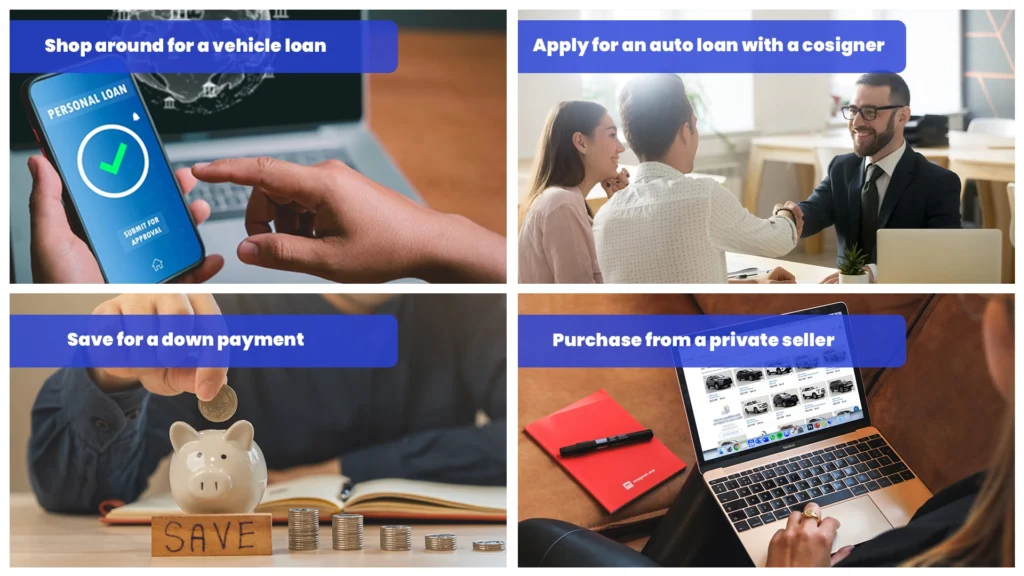

Shop around for a vehicle loan

Most banks, online lenders, and credit unions do not offer auto loan financing to individuals with bad credit scores. However, they often offer programs for individuals with less-than-stellar credit scores. Therefore, people with less-than-stellar credit scores might get an auto loan with a reasonable interest rate. This will also help them build their credit history.

Apply for an auto loan with a cosigner

A cosigner with a good credit score can fill out the applicable loan, committing to pay the loan if you do not. Therefore, with the help of a consigner, you have a better chance to get a traditional loan. However, if both the car buyer and cosigner fail to pay the loan, the credit score would be impacted for both individuals.

Save for a down payment

We advise you to take time and save your money for a down payment. It might help individuals reduce the amount payable in interest, and you might qualify for a traditional car loan. Therefore, a sizeable down payment amount will help individuals save money in the long run and make their monthly payments more affordable.

Purchase from a private seller

You might find affordable online car sales from a private seller compared to a used car lot. Additionally, you can secure financing or pay cash on your own. Therefore, no strings are attached once you buy a car from a private seller, unlike from a buy here pay here dealership. Additionally, there is a high chance that you might get a car in better condition.

Example of Pay here buy here

Let’s understand how “pay here buy here” works for a car buyer with an example. Suppose you have a bad or no credit score and are not qualified for an auto loan from a credit union or a bank. However, owning a car to perform your daily tasks is essential. Further, you decide to visit the dealership to find a budget vehicle for yourself.

The automotive dealer offers to finance your car loan. However, the interest rate on buy here pay here auto sales car selling platforms loan will be 20%, and you must make bi-weekly payments in person. Additionally, as part of the deal, you agreed and allowed the dealer to place GPS tracking devices on your vehicle in case they have repossessed it.

When Can a BHPH Dealer Reposses a Car?

As state law requires, asking the buy here pay here dealer about the repossession policy before purchasing a car is essential. Knowing what can happen if you do not pay or cannot pay your monthly installments is advised. The dealership’s repossession policy can vary as per each state. Additionally, some dealers will reach a mutual agreement if you cannot afford the monthly payment in the future. We advise you to clear the terms and conditions before signing the contract. It will also help you understand whether to work with this dealer.

Sometimes, your vehicle might be repossessed without any prior notice immediately after your first late payment or default. Sometimes, dealers install a kill switch and a tracking device. Therefore, it won’t make your vehicle start if you miss any payment.

The best way to avoid having your vehicle repossessed is to pay on time every month. If you are struggling financially. We advise increasing your income, cutting down on your few expenses, or gaining access to financial assistance. A repossession of your vehicle will be reported on your credit report. Therefore, it will create barriers for you to access traditional automotive financing options in the future. However, there is a possibility that you won’t find any difficulty in the future when you buy a vehicle from a traditional dealer. The dealer failed to perform credit checks and report any missed payments to credit bureaus, even after repossessing your vehicle.

Conclusion

While buy here pay here car dealerships can be valuable for individuals with poor or no credit scores. However, they also bring risks like high interest rates and limited vehicle choices. We advise exploring alternatives like saving money for a down payment and applying for an auto loan with a cosigner. Individuals can also check out leasing a luxury car, which would be beneficial as it will have a lower monthly payment installment. However, BHPH dealers offer car buyers a smooth and quick process, which streamlines their car shopping experience.