Buying a used car is a smart choice for many, offering significant cost savings over purchasing a new vehicle. However, it can also be a complex process fraught with potential pitfalls. A comprehensive Used Car Buying Guide checklist is an invaluable tool for successfully navigating this used car buying journey. This is the best buying used car guide or auto buying guide that covers all critical aspects of buying a used car, from understanding warranties and “as is” conditions to obtaining and interpreting vehicle history reports. Secondhand car guide emphasizes the importance of professional inspections, explores various payment options, and outlines the steps to take if issues arise after the purchase with the help of a car sales guide.

Furthermore, the guide to buying a used car from a dealership provides practical advice on negotiating, test driving, and managing the necessary paperwork, ensuring you are well-equipped to make an informed decision. Whether dealing with dealerships or private sellers, this guide aims to empower you with the knowledge to secure a reliable vehicle at a fair price, making your car-buying experience as smooth and successful as possible.

What is a Used Car Buying Guide?

A used car buying guide tells you about car details, such as whether the car is under warranty or not or whether it is being sold in “as is” condition. This second-hand car buying guide also has information about vehicle history reports, independent inspections, available payment options, & all the necessary actions you can take in case of any problems after the final deal. Additionally, it includes used car buying tips for negotiating, advice on test driving, and a used car buying checklist of necessary documents, ensuring buyers make informed and confident decisions when buying from dealers or private sellers.

How to Buy a Used Car?

Buying a used car is a good decision if you want to save money, as you don’t have to spend on car insurance, taxes, registration, depreciation & more. However, choosing the right car is complex; currently, vehicle supply is limited in the used car market, and prices are getting higher daily. But we are here to help you with these challenges. Here is a buying used cars guide; follow the classic car buyer’s guide or old car buyer guide’s steps for buying a car:

Determine Your Budget

There are two ways to purchase a used car: buying on cash or lending a loan. We suggest you avoid draining your savings account if you’re paying with cash. Leave enough money for car registration, insurance fees, and possible repairs. If you decide to finance, get pre-approved for a loan. It’ll make the process smoother and give you bargaining power.

You can use an auto loan calculator to understand what you can comfortably put down and make as a monthly payment and aim for a 10% down payment. Further, set a budget so that your total car expenses—your car payment, gas money, and insurance—don’t exceed 20% of what you take home. You can also consider long-term expenses, including insurance, maintenance, repairs, and depreciation.

Choose the Features You Need

Before making a final decision, you must consider how you’ll use the car and what features are most important to you—size, cargo space, and safety. If safety is a top priority, research the Insurance Institute for Highway Safety crash tests for different models. You can choose models with a history of being reliable because some used cars may have more wear and tear due to high mileage. Further, you can write down your must-haves and research models that match your criteria.

Find Reliable Pre-owned Cars in Your Budget

You can find car inventory online and consider browsing online car marketplaces and retailers’ websites to find the best car for yourself. However, if you are a buyer who likes to inspect the vehicle physically, consider visiting the dealership in person. We have mentioned the best online car-buying retailers and marketplaces below.

- Online Marketplaces: Used Car Search Pro, Autotrader, and Autolist aggregate listings from individuals, dealerships, and online retailers. After you find the listing of your choice, these platforms share the seller’s contact information with you.

- Online auto retailers: Carvana and CarMax have a return policy allowing you to return the vehicles if unsatisfied. They also own the inventory, and you can complete the buying process for your car online.

- Traditional private-party sales platforms: If you want to purchase a pre-owned vehicle from a private party, you can consider platforms like Facebook Marketplace Cars & Craigslist. On these platforms, you can complete your purchase swiftly with a great deal. However, you must be careful about scammers.

Check Your Car’s Price

Before visiting to inspect the vehicle physically, you can use Kelley Blue Book, Edmunds, or the National Automobile Dealers Association to get an idea of the market value of a specific car based on its age, mileage, and options. Knowing the car’s market value you want to buy will help you negotiate better. Car buyers’ price guides or selling car price guides are helpful because they provide different prices depending on the vehicle’s seller. They might also show the trade-in value for your present car.

Get a Vehicle History Report

A vehicle history report gives information on previous ownership, accidents, title information, mileage, and service history. Online advertisements may also include some free vehicle reports; otherwise, the dealer may be able to supply this information. Buy a vehicle history report from a trusted source like Carfax or AutoCheck.

Contact the Owner (If Buying Privately)

Contact the seller to confirm the vehicle is available and ask questions about its condition and history. You can also include questions like,

- Are you the first owner of the car?

- Are the vehicle service records available?

- Do you have the title, and is it clear? (A clear title shows no liens on the car.)

- How did you set the asking price?

- Is there any critical information that was not in the ad?

- Can I have the car inspected by a professional mechanic?

Test Drive the Vehicle

Test drive the vehicle before buying it to ascertain potential problems and get a feel for its handling, acceleration, braking, ergonomics, and features. While taking a test drive, you can also remember the essential considerations.

- Before starting your test drive, check the warning lights, engine, brakes, oil pressure, etc. Select a test-drive route and include hills, highways, curves, rough terrain, and pavement to check the vehicle’s condition on each path.

- Check the mechanical condition or visibility of the vehicle. Include the blind spots, brake response, vibrations, or unusual voices in your inspection.

- Check all the features, including the back-seat legroom, sound system, and cargo capacity.

Get the Inspection Done

After choosing the perfect car for yourself, bring it to a professional mechanic. Car inspections can cost up to $100-300. Have the vehicle checked by a qualified mechanic to identify any significant repairs it may need. If the dealer claims the inspection has already been done and refuses to inspect under your surveillance, it might be a sign that a vehicle is untrustworthy.

Negotiation is Key

Having an actual idea about the car’s worth and being prepared to close the deal can help you negotiate better and get the best price for your desired vehicle. Check the best negotiating tips for buying a used car at a dealership below to help lock in your best deal.

- Come prepared with research about the vehicle’s value to negotiate effectively.

- Make an initial low offer and gradually increase it in small increments.

- If negotiations aren’t progressing or you feel uncomfortable, don’t hesitate to walk away.

Find Affordable Used Car Financing (if needed)

Preapproved financing puts you in a stronger position and simplifies the buying process. Dealers may offer to finance, but you should compare their rates with other potential lenders to get the best-used car pricing guide.

Finalize Your Purchase

Once the price is agreed upon, close the deal, get the title, and ensure the seller signs it correctly. Red flags are if the seller’s name isn’t on the title. In that case, title jumping could be illegal. Check your state’s registry website for more information. Depending on your state, title transfers usually must be done within 10, 15, or 30 days.

By following these steps, you can better your chances of finding a reliable used car at a fair price!

Where to Shop for a Car Loan?

You can get a loan from various sources, such as banks, credit unions, financial institutions, etc. The rate of interest and terms and conditions may vary depending on the source from which you are getting your loan. This used car buying guide 2024 lists a few of the most common sources below. From there, you can get a loan:

1) Banks

Banks have a conservative and specific loan policy and high fees on loans. They only cater to borrowers with better credit standing, and these institutions offer more competitive loan rates. Although most borrowers have at least a connection with a specific bank, they might get a loan on marginal credit. You can also check the loan rates on the bank’s website and apply online. However, visiting a bank physically might help you get a better offer and avoid misunderstandings.

- Large National Banks: A few national banks offer personal loans with competitive rates and in-person support.

- Community Banks: Local community banks might offer more personalized service and competitive rates than larger institutions.

- Online Banks: Online banks often provide quick and convenient loan options with competitive rates and easy application processes.

2) Credit Unions

Credit unions operate like banks. However, they primarily lend loans to their members only. A few credit unions also lend loans to people who do not have deposit accounts with them. Car buyers can consider lending loans from credit unions, as their operating costs are lower than those of banks and are owned by depositors who run on nonprofit. Car buyers can inspect the credit.com website, which links various credit union lending loans to the general public.

3) Online Lenders

Car buyers can get competitive rates when lending money. They can browse sites like LendingTree farm, E-Loan, and Clearlane (operated by Ally Bank) that request various lenders and provide competing offers. You can also approach individual lenders with online loan operations like Chae, Wells Fargo, and Capital One. Remember to check the Better Business Bureau ratings for each lender you contact before filing an online loan application.

4) Dealerships

A new or used car dealership works with banks, automakers’ financing groups, or other sources. Research is essential, as lenders with existing offers from other sources can negotiate with car dealers and ask them to quote a more attractive offer.

5) Comparison Websites

Loan comparison websites are the easiest way to get a great finance deal and require minimum effort. Filling out a single application will allow the site to contact numerous lenders and get financing offers. The funding and collection of the car loan are done electronically. Also, the lender could be from any source, including a finance company from any other country, a bank, or a credit union.

6) Finance Companies

Finance companies operate like banks. However, they do not accept deposits; their business is just to lend money to borrowers. These finance companies borrow money from other financial institutions and lend the same money to citizens with poor credit. Automakers like Honda Financial Services or Ford Motor Credit own finance companies, and captive finance companies that work with specific lenders are Santander lending partners and Mitsubishi. They also provide lending for certified used car financing offers, lease deals, and new car financing deals.

How to Apply for Used Car Financing?

Buying a used car guide is a smart and budget-friendly decision. However, navigating the world of used car financing can be complex, and that is where used car buying guides or consumer guides used cars play a vital role. Here is the breakdown of the key steps to take to apply for the best possible loan for your situation:

1) Check Your Credit Score

Check your FICO and credit scores. A good score, i.e., 670 or above, will help you get a lower-interest loan. You can reduce your credit card balance, catch up on late payments, and pay bills on time to increase your credit score.

2) Determine Your Budget

You must check the average price of a used car on automotive industry sites or numerous dealers’ websites. Additionally, your aim should be to arrange a down payment of at least 10% or more of the car’s price. Remember, the more you initially pay your down payment, the less you will have to borrow. You should also check the payable monthly installments and review your budget to ensure you have the desired car you can afford.

3) Research Lenders & Get Pre-approved

Car buyers must get pre-approved loans from three to five lenders, which will help them to make a better choice. You must submit your applications, including credit score models, in one hard inquiry within 14 days. Therefore, it will help you minimize any negative impact on your credit score, and pre-approved loans will give you an idea of the interest rate, loan amount, and other terms available.

4) Compare Loan Offers

You must compare different loan offers (APR), which are annual percentage rates, including fees and interest, on the total cost of borrowing. Use car payment calculators to check the various loan amounts that affect your interest and monthly payments. Further, a short loan term will have a lower interest, but your monthly payments will increase.

5) Apply for Your Best Offer

Once you have preapproved your loan from multiple lenders and have chosen the perfect loan that fits best for you, you must complete the official loan application to finance your desired pre-owned vehicle, as preapproval loans might differ from the final loan approval.

Best Place to Buy a Used Car?

If you are looking to buy a used car, deciding the right place to buy a car is highly crucial. The best place to buy a used car completely depends on one’s needs and requirements. Generally, when buying a used car, you may have two options: an auto dealership or a private party, but you may also have various other options. With the used car buying guide, explore where you can buy a used car:

1) Franchised New Car Dealers

Franchised dealerships offer many different brands, a vast section of which can provide additional choices. They sell both new and used cars and also offer financing options.

2) Independent Used Car Dealers

Consider researching independent used car dealerships before buying. They can be cheaper and easier to get financing from but may have less inventory and financing options than bigger dealerships. Do your research on both the dealership and the car itself before making a purchase.

3) Online Car Sellers

A guide to buying a used car online will help you to be more convenient and get a wider selection, but it has similar risks to buying from private sellers. You’ll need to research the seller and handle the paperwork, but you may not inspect the car in person.

4) Private-Party Sellers

Buying a used car from a private seller can be simpler and potentially cheaper than a dealership, especially if you know the seller. However, you’ll need more legwork to verify the car’s condition and handle the paperwork yourself. There’s also less guarantee of quality compared to dealerships.

5) Buy Here, Pay Here Dealers

Buy here, pay here (BHPH) dealerships offer financing for car purchases, even for those with bad or no credit. This can be an option for people who might not qualify for traditional loans.

How to Find The Right Used Car?

Finding the right used car with a used car buying guide involves research and due diligence before you hand over your hard-earned money. Here’s a car checklist before buying to guide you through the process:

1) Vehicle History Report

A vehicle history report, also known as a vehicle history file or VHR, is a detailed document that tracks a car’s life. It includes information like:

Flood, Fire, or Other Damage: This will reveal if the car has ever been in a major accident that resulted in significant water, fire, or other types of damage.

Collisions: The report will detail any accidents the car has been involved in, including the severity of the damage.

Title Status: This will tell you if the car has a clean title or has ever been salvaged or rebuilt. A salvaged title means the car was once deemed a total loss by an insurance company.

Ownership: The report will show you how many previous owners the car has had.

Odometer Readings: This will reveal any discrepancies in the mileage readings.

Maintenance and Service History: This section should ideally show a record of the car’s maintenance and repairs, helping you gauge how well it has been taken care of.

Registration and Inspection Information: This will include details like the car’s registration status and any outstanding recalls.

You can obtain a vehicle history report from various sources, including online services like CARFAX, AutoCheck, or your local DMV.

2) Get a Test Drive

Taking a test drive of the car is very important & plays a vital role. It lets you get behind the wheel and see how driving the car feels. Here are some things to pay attention to during your test drive:

- The way the car starts and idles

- The acceleration and handling

- The braking system

- The overall condition of the interior

- How comfortable the seats are

- The functionality of all the car’s features

3) Get Mechanical Inspection

Before you finalize your purchase, having the car inspected by an independent mechanic is always a good idea. This will give you a professional opinion on the car’s condition and help you identify potential problems.

Best Used Car Buying Tips and Tricks From a Private Seller

Purchasing a used car from a private seller can be complex. However, making the process safer and smoother is always possible. We have mentioned the best tips that you must consider when buying a used car from a private seller.

1) Do the Research

You must know the fair price range of the vehicle, and you can use resources like Kelley Blue Book or Edmunds. Additionally, ask for a vehicle history report, including the service and accident reports.

2) Inspect the Car Thoroughly

We advise you to schedule a daytime meeting to inspect the vehicle’s body, paint, and interior damage. You can also use Spyne’s vehicle damage tagging to make this inspection process smoother. Include the document verification and test drive in your vehicle inspection.

3) Get a Mechanic’s Opinion

It is always better to get the vehicle checked by a professional mechanic in detail. They will provide a detailed report about the vehicle’s existing and potential mechanic problems.

4) Documentation

You must contact the local department to change the vehicle title. Also, ensure the signatures, correct selling price, and vehicle condition details are included in your documents.

5) Secure Payment Method

Complete the transaction using a safe mode of payment, such as a money order or cashier’s check. Do not pay the full amount in advance, and avoid making transactions in cash.

Negotiate and Finalize the Paperwork

Now that you are done with all the checks, you have your dream car with a used car buying guide, and now is the time to seal the deal and complete the necessary paperwork. Here we listed below what you need to do next:

Negotiate a fair price: Negotiation is the key to getting the right price. Research the market value and condition of the car beforehand. Start offering low for the asking price. Feel free to leave if you are uncomfortable with the quote.

Signing Documents: Read the documents carefully, and if any points are unclear, clarify the misunderstanding immediately to avoid confusion later. Understand the terms and conditions to understand the fee involved.

Beware of Yo-Yo Financing: Yo-yo financing is a deceptive practice in which a dealer approves you for a loan at a low interest rate but contacts you later to say they need to rework the financing due to new information. This often results in a higher interest rate for you.

Used Electric Car Buying Guide

EV owners are looking to trade for new electric vehicles or are individuals who have never bought one. This guide will help you make the perfect decision. If you plan to buy a used EV, consider the following points. Also, check the EVs benefits and disadvantages of buying a used car from the dealer.

- Compare the total cost of fueled vehicles from EVs, including fuel savings and low maintenance costs.

- Research the remaining warranty coverage and battery health of a used electric car.

- Remember the EV charging rates and range they give in one charge per your daily distance coverage.

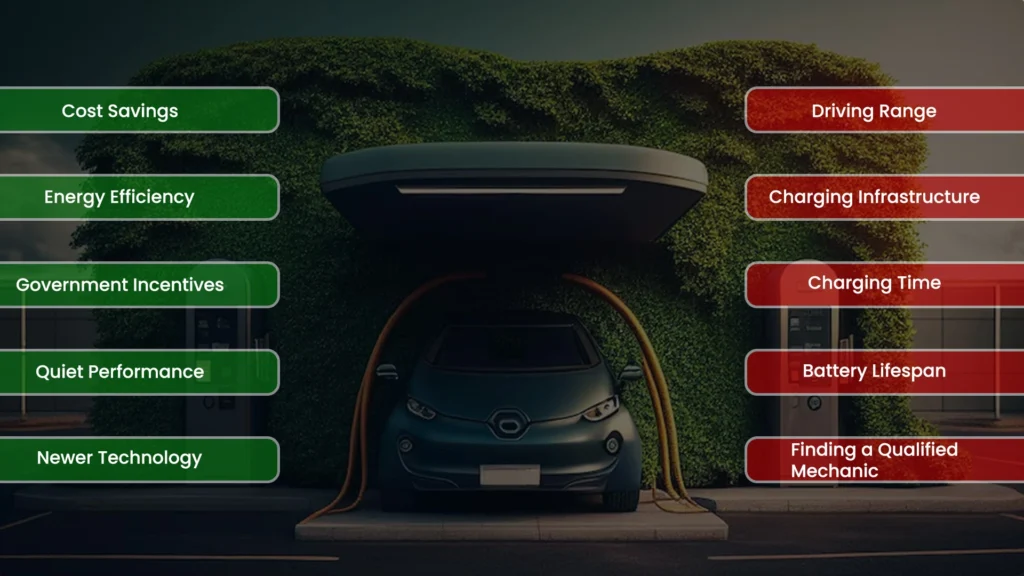

Benefits vs. Drawbacks of an EV

| Benefits | Drawbacks |

| Cost Savings: You will save money on regular maintenance and fuel expenses. | Driving Range: Planning long trips will not be a successful idea because they have a limited driving range. |

| Energy Efficiency: EVs convert electrical energy to power, making cars more efficient. | Charging Infrastructure: Finding charging stations is challenging, and installing one at your home requires dedicated, experienced electrification. |

| Government Incentives: You get incentives, rebates, and tax credits from federal, state, and local governments. | Charging Time: Charging your EVs can take a few hours, which can be a limitation when you are in a hurry. |

| Quiet Performance: EVs offer a quiet and smooth driving experience. | Battery Lifespan: EV’s battery life decreases over time, and installing a new one can be expensive. |

| Newer Technology: These vehicles have new, advanced, and innovative technologies. | Finding a Qualified Mechanic: Finding a certified mechanic to repair a complex old EV is hard. |

Key Considerations for Buying a Used Car

There are a few most important things to look for when buying a second-hand car or tips for buying a second-hand car in the used car buying guide. Let’s explore these factors in detail:

1) Add-Ons: Don’t be afraid to ask for extras! Common add-ons include floor mats, roof racks, or a tow hitch. Sometimes, the seller might be willing to include these to sweeten the deal.

2) Warranty: Check to see if the car has any remaining manufacturer’s warranty. This can save you money on repairs in the future. If the warranty has expired, consider purchasing an extended warranty for peace of mind.

3) Insurance: Verify if the car has valid insurance. If not, factor in the cost of getting appropriate coverage before finalizing the purchase. Shop for different insurance quotes to ensure you get the best rate.

Used Car Buying Guide Consumer Report 2024

Consumer Reports used car buying guide 2024 top picks emphasize affordability, safety, and reliability over fancy features and high speed. The list includes a mix of hybrid, plug-in hybrid, and fully electric models, with over half starting under $30,000.

Top Points

1) Affordable: Over half of the best models start at less than $30,000.

2) Safety and Reliability: Focus on practical, safe, and reliable vehicles.

3) Fuel Efficiency: Many models boast high EPA mileage ratings.

| Category | Model | Price Range ($) | Safety Rating |

| Compact SUV | Subaru Forester | 27,095 – 37,395 | 5 Stars |

| Subcompact | Subaru Crosstrek | 25,195 – 32,195 | 5 Stars |

| Midsized Car | Toyota Camry Hybrid | 28,855 – 34,295 | NA |

| Top Hybrid | Toyota Prius / Prius Prime | 27,950 – 39,370 | NA |

| Midsized SUV | Toyota Highlander Hybrid | 40,720 – 53,125 | 5 Stars |

| Hybrid SUV | Toyota RAV4 Prime | 43,690 – 47,560 | 5 Stars |

| Small Pickup | Ford Maverick / Maverick Hybrid | 23,815 – 34,855 | 4 Stars |

| Electric Vehicle | Tesla Model Y | 43,990 – 52,490 | 5 Stars |

| Small Car | Mazda3 | 24,170 – 36,650 | 5 Stars |

| Luxury SUV | BMW X5 / X5 PHEV | 65,200 – 89,300 | 4 Stars |

Note: The given data has been sourced from AARP Org. Report

Conclusion

In the used car marketplace, things can be a bit tricky. Still, with the help of a used car buying guide or used car buying advice, if you approach the problem rightly and are prepared in advance, you will get a reliable vehicle that answers all your needs and budget. By following these steps, you will make informed choices at every juncture—from setting a realistic budget and getting financing to picking the right car and negotiating a fair price. Necessary actions, such as getting a vehicle history report, conducting a proper test drive, and having an independent mechanical inspection, help ensure the car’s reliability and value. Additionally, knowing where to purchase—from a dealership, a private seller, or an online platform—assists in making the right choice.

Finally, knowing key considerations such as warranties, insurance, and possible additional costs will further protect your investment. If diligent and armed with the knowledge provided here, you will get a used car that will be your faithful companion for years, resulting in utmost satisfaction and peace of mind.